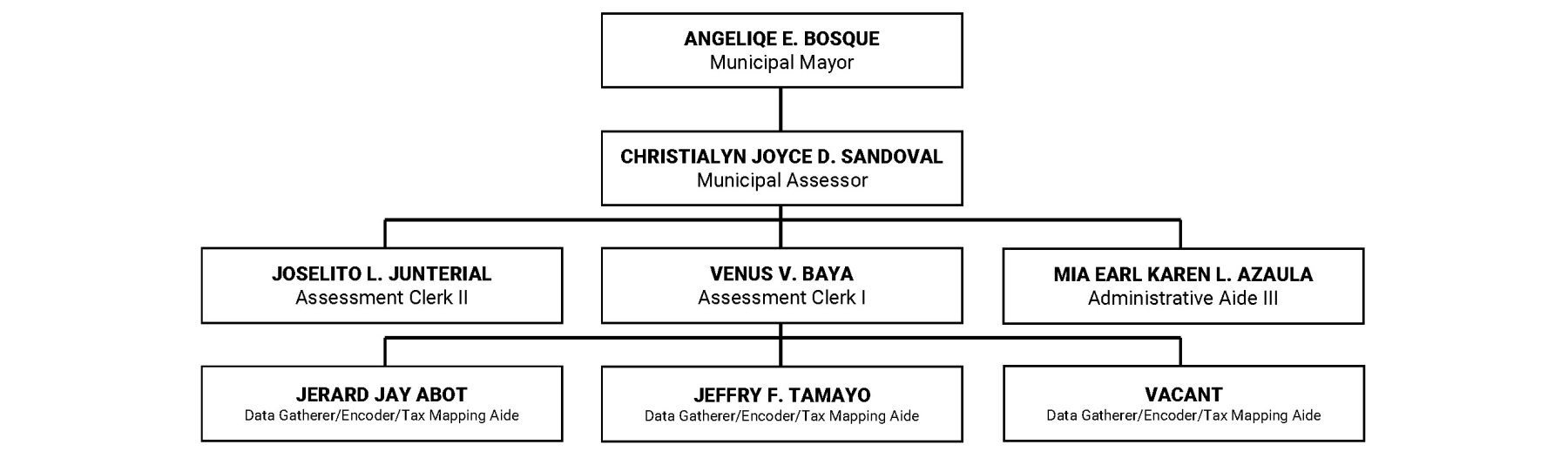

CHRISTIALYN JOYCE D. SANDOVAL

Municipal Assessor

- Responsible in Providing Quality Assessment Services.

- Appraise and Assess Real Properties within the Municipality for taxation purposes based on Schedule of Market Value approved by the Sangguniang Panlalawigan.

- Issue certifications pertaining to assessment records of real properties.

JOSELITO L. JUNTERIAL

Assessment Clerk II

- Verify, review and evaluate documents for issuance of Tax Declaration.

- Conduct ocular inspection and verification of real properties subject for appraisal and assessment.

- Assist and attend to clients.

- Deliver and send notices relative to assessment matters.

- Assist in the conduct of Tax Mapping operations.

- Other tasks that may be assigned by the supervisor.

VENUS V. BAYA

Assessment Clerk I

- Prepare Tax Declaration for real properties located in barangays with code numbers from 0001 to 0010.

- Prepare Certifications relative to assessment matters.

- Prepare and Update Roll and Record of Assessment.

- Assist and attend to clients.

- Assist in the preparation of monthly quarterly report on real property assessment.

- Receive incoming communications / prepare and send outgoing communications and other notices.

- Assist on conducting Tax Mapping Operations.

- Others task that may be assigned by the supervisor.

MIA EARL KAREN L. AZAULA

Administrative Aide III

- Prepare Tax Declaration for real properties located in barangays with code numbers from 0011 to 0020.

- Prepare Certifications relative to assessment matters.

- Prepare and update Ownership Record Card.

- Assist and attend clients.

- Conduct ocular inspection of real properties subject for assessment and reassessment.

- Deliver and send notices relative to assessment matters.

- Prepare base map for each barangay for tax mapping.

- Other tasks that may be assigned by the supervisor.

JERARD JAY ABOT

Data Gatherer / Encoder / Tax Mapping Aide (JO)

- Assist in conducting Tax Mapping operations.

- Assist / conduct ocular inspection of real properties and gather necessary information for the appraisal and assessment of real properties.

- Perform other duties to be assigned by supervisor.

JEFFRY F. TAMAYO

Data Gatherer / Encoder / Tax Mapping Aide (JO)

- Assist in conducting Tax Mapping operations.

- Assist / conduct ocular inspection of real properties and gather necessary information for the appraisal and assessment of real properties.

- Perform other duties to be assigned by supervisor.

VACANT

Data Gatherer / Encoder / Tax Mapping Aide (JO)

- Assist in conducting Tax Mapping operations.

- Assist / conduct ocular inspection of real properties and gather necessary information for the appraisal and assessment of real properties.

- Perform other duties to be assigned by supervisor.

MANDATE

The Assessor’s Office shall take charge of the discovery, classification, appraisal, assessment and valuation of all real properties within his territorial jurisdiction which shall be used as the basis for taxation. it also includes the preparation, installation and maintenance of system of tax mapping and records management and the preparation of a Schedule of Fair Market Values of the different classes of real property within his territory.

VISION

The agency upholding standards of honesty and integrity in providing just, uniform and equitable real property tax administration.

MISSION

To advocate changes in systems, policies and procedures in accordance with the law in order to generate sustainable revenues from realty taxes with due care and convenience to taxpayers and the clientele.

SERVICE PLEDGE

We commit to:

- Observe humility and honesty at all times to deliver the most efficient and quality service to our clients.

- Uphold our clients trust and rights by keeping real property assessment records safe and intact.

- Competently perform a just and uniform real property appraisal and assessment while ensuring that all properties are properly listed in the real assessment roll.

- Continually explore innovative ways and systems to improve and upgrade the quality service delivery in consistent with the governing laws in real property taxation.